Documentary Letters of Credit

Issue Letters of Credit Without Collateral

At Nehan Financing Broker, we specialize in facilitating smooth international trade through our expertise in Documentary Letters of Credit (DLCs). As a trusted partner in global finance, we simplify complex transactions, ensuring that sellers receive payment upon fulfilling the required conditions, while buyers gain confidence that payments are only made when all terms are met. This system offers a secure and reliable method for handling international payments, protecting the interests of all parties involved. Let Nehan Corp Advise guide you through the intricacies of global trade with our dependable DLC services.

The Documentary Letters of Credit Are Mainly Divided into Two Types:

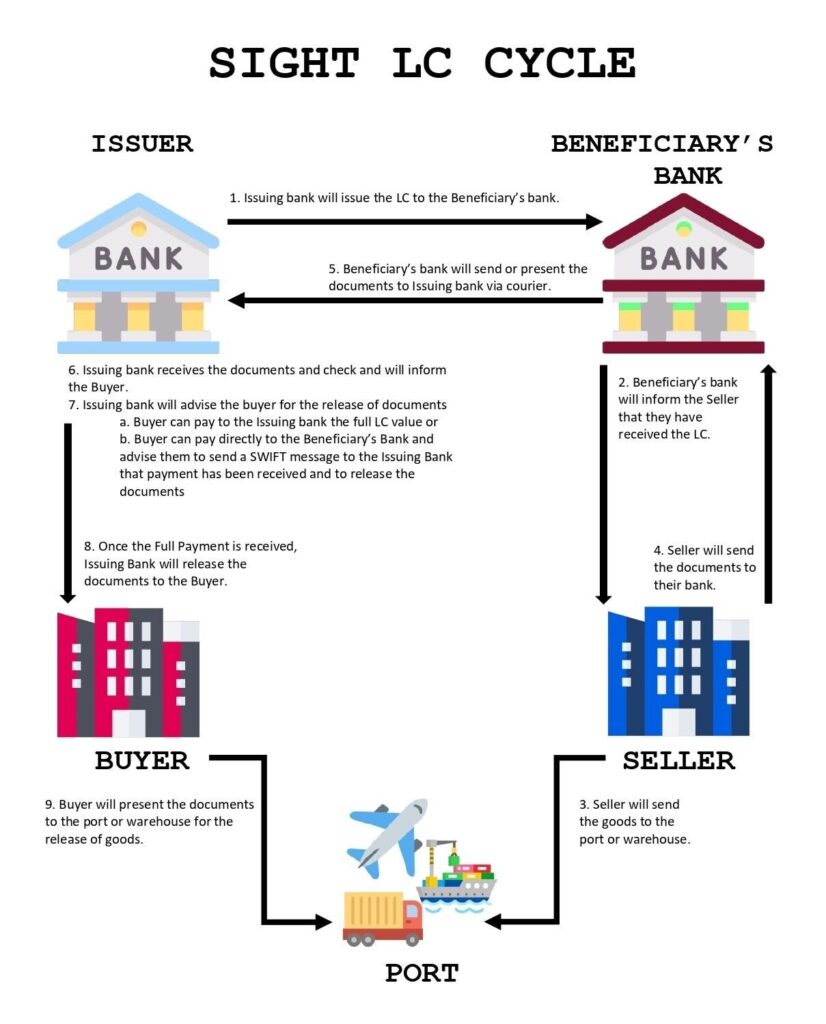

Letters of Credit at Sight

A Sight Letter of Credit (LC) is a crucial financial tool that provides assurance to both exporters and importers by ensuring that payment and delivery obligations are met through their respective banks. The “At Sight” designation indicates that the issuing bank will promptly release the necessary shipping documents as soon as the buyer’s payment is confirmed, facilitating a secure and seamless transaction for all parties involved.

Benefits of a Sight LC:

- Sellers benefit from reduced risk, as they do not have to receive advance payments.

- The risk of shipping goods without a guarantee is minimized, providing peace of mind to all involved.

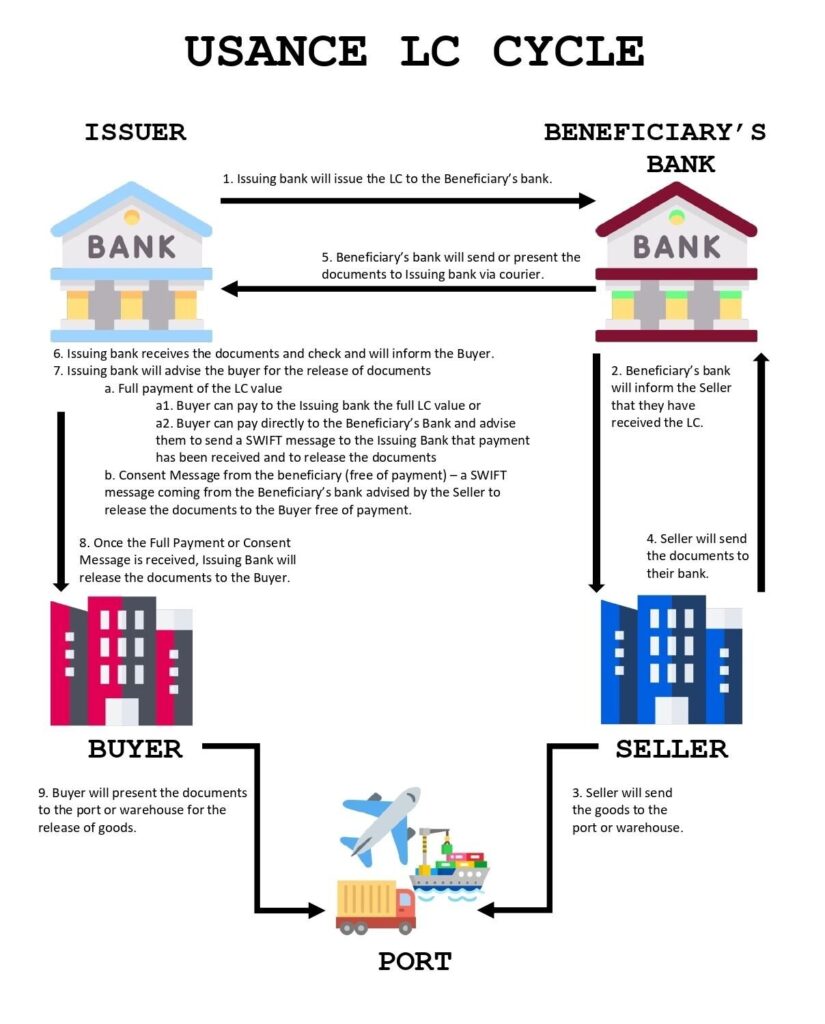

Usance Letters of Credit

Usance Letter of Credit (LC), also known as Deferred Payment LC, offers adaptable payment terms to accommodate the needs of both buyers and sellers. This financial instrument allows payment to be postponed for a specified duration, commonly ranging from 60 to 180 days. It’s particularly beneficial for importers and exporters with established relationships, providing the advantage of extended credit while guaranteeing the fulfillment of contractual commitments.

Benefits of Usance LC:

- Customers can delay payments, improving their cash flow management.

- Buyers receive goods before the payment deadline, giving them sufficient time to inspect and confirm quality standards.

DLC Issuance Procedure- Step By Step

DLC Issuance Procedure:

1. In order to finalizing the draft , we need following documents/ information.

i. Filled-in Application form/ Proforma Invoice or Sales Contract

ii. Company Trade License

iii. Passport copy of the owner and shareholders

iv. Last three months bank statement

v. One-year audited financials

vi. Shareholding List

2. After acquiring all the above documents/information, we will assist the client in selection of the issuing bank/financial institution and assist in finalizing the draft for client’s review.

3. Upon receiving the draft copy of the instrument, client must thoroughly review the draft for any corrections, additions or removal of information. Should there be any amendments, we can assist in amendment of the draft accordingly to match clients’ preferences. Once the draft is approved by all the related parties, client will need to send us a copy of the draft with authorized signatory’ sign and company stamp on the draft as client’s approval along with an email confirming the same.

4. We will raise the invoice for the charges agreed and client will make the remittance against the invoice.

5.Only after we receive the payment for the raised invoice, we will assist on following with the issuing bank/financial institution consulted and provide assistance in issuing the instrument through swift/courier within 7 working days depending the issuing bank/financial institution policy.

6. Simultaneously we will assist the client in receiving the issued copy through email for reference and record keeping.

Note: The issuing charges would depend on the amount of the LC required, the type of the LC, the issuing bank selected for issuance and the beneficiary bank to which it is to delivered.