Bank Guarantees

Your Reliable Source for Bank Guarantees

At Nehan Financing Broker, we’re a top global provider of Bank Guarantees, offering the financial security you need in international trade. Our Bank Guarantees ensure that customers fulfill their contractual obligations, with the bank compensating the beneficiary in case of default.

Designed to mitigate risks and foster trust, our customizable solutions protect your interests in commercial transactions. With Nehan Corp Advise, you can confidently navigate the complexities of global trade and focus on growing your business. Explore our offerings and secure your trade journey today.

Types of Bank Guarantees

There Are Mainly 4 Types Of Bank Guarantees In International Trade

Bid Bonds:

Secure your projects with confidence at Nehan Financing Broker. Our bid guarantees ensure that bidders are committed to undertaking the project if awarded. This protection safeguards project owners from the risk of the selected bidder not commencing the project as promised.

Performance Guarantees:

Guarantee that contractors will uphold their contractual obligations with Nehan Financing Broker. Our performance guarantees protect buyers from potential losses if the contractor fails to deliver as per the agreed terms, ensuring a smooth and reliable project execution.

Advance Payment Guarantees:

Safeguard buyers by ensuring that any upfront payments are returned if the seller doesn't fulfill their obligations. Our advance payment guarantees provide peace of mind, assuring buyers that their payments are protected and will be refunded if the goods or services aren't delivered as agreed.

Payment Guarantees:

Guarantee that sellers will be paid upon fulfilling contractual terms. This assurance minimizes the risk of non-payment, offering financial protection and fostering confidence in global trade dealings.

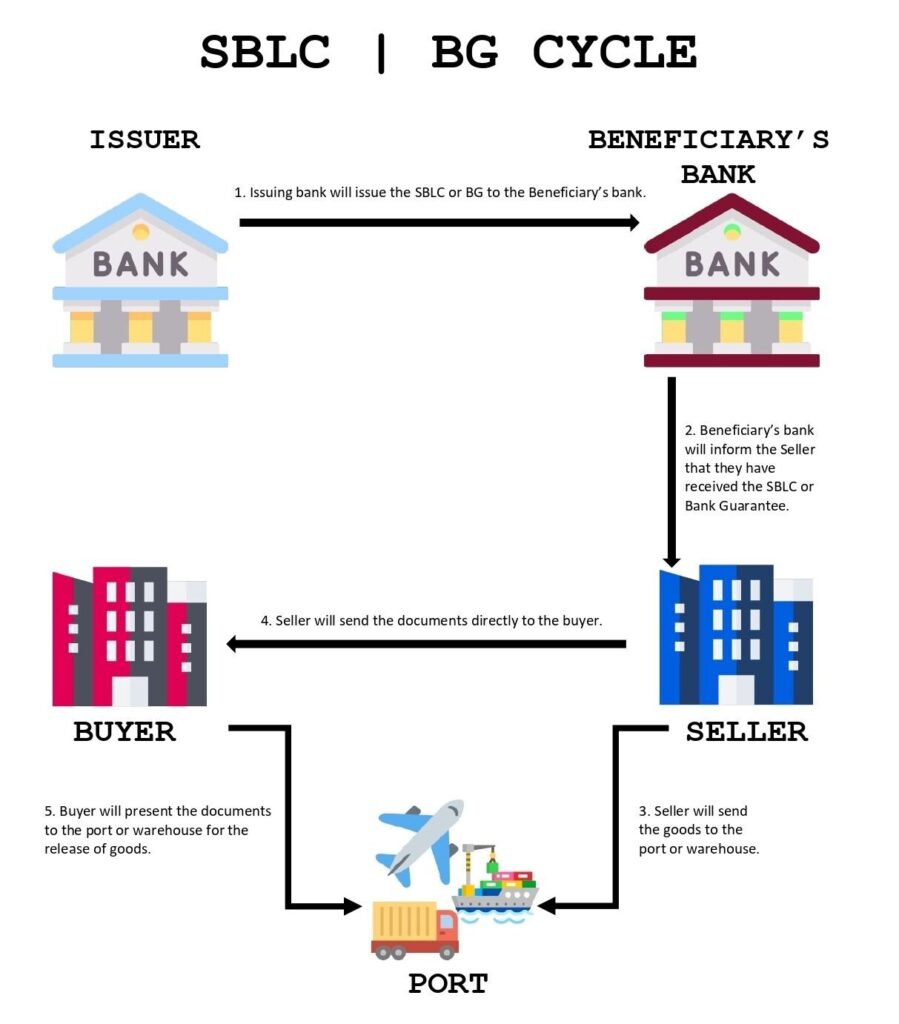

Bank Guarantees Issuance Procedure- Step By Step

Bank Guarantees Issuance Procedure:

1. In order to finalizing the draft , we need following documents/ information.

i. Filled-in Application form/ Proforma Invoice or Sales Contract

ii. Company Trade License

iii. Passport copy of the owner and shareholders

iv. Last three months bank statement

v. One-year audited financials

vi. Shareholding List

2. After acquiring all the above documents/information, we will assist the client in selection of the issuing bank/financial institution and assist in finalizing the draft for client’s review.

3. Upon receiving the draft copy of the instrument, client must thoroughly review the draft for any corrections, additions or removal of information. Should there be any amendments, we can assist in amendment of the draft accordingly to match clients’ preferences. Once the draft is approved by all the related parties, client will need to send us a copy of the draft with authorized signatory’ sign and company stamp on the draft as client’s approval along with an email confirming the same.

4. We will raise the invoice for the charges agreed and client will make the remittance against the invoice.

5.Only after we receive the payment for the raised invoice, we will assist on following with the issuing bank/financial institution consulted and provide assistance in issuing the instrument through swift/courier within 7 working days depending the issuing bank/financial institution policy.

6. Simultaneously we will assist the client in receiving the issued copy through email for reference and record keeping.

Note: The issuing charges would depend on the amount of the BG required, the type of the BG, the issuing bank selected for issuance and the beneficiary bank to which it is to delivered.